Financial Analysis for Beginners

Why is Financial Analysis Important For Anyone Who is going to Buy Sell or Invest in businesses?

Financial statements are the most important resource for ANYONE who’s looking to buy, sell or invest in a company. All companies are required to file their financial statements to their respective countries’ tax department.

Think of financial statements as a medical record, and you’re the doctor who’s using these records to diagnose the company.

In our previous article 5 Steps to Assess Company Viability, we mentioned how to assess a company. So, today we’ll be going through:

1. Balance Sheet – What to look for in a Balance Sheet

Current Assets:

can be turned into cash, because they have a shelf life of lesser than 12 months. Short-term assets include Accounts Receivable, Inventory, Cash & Cash Equivalents.

Intangible Assets:

is not something physical, For example, a brand, goodwill, patents, copyrights, and trademarks.

Current Liabilities:

Debts must be paid within 12 months. Short term borrowing, the current long term payment

Long-term Debt:

Due in one year or more. A company records the Market Value of its long-term debt on the balance sheet, which is the amount necessary to pay off the debt.

Shareholder equity:

Shareholder equity represents the portion of the company that belongs to its owners. Equity can be increased by reinvesting profits or by paying down debt.

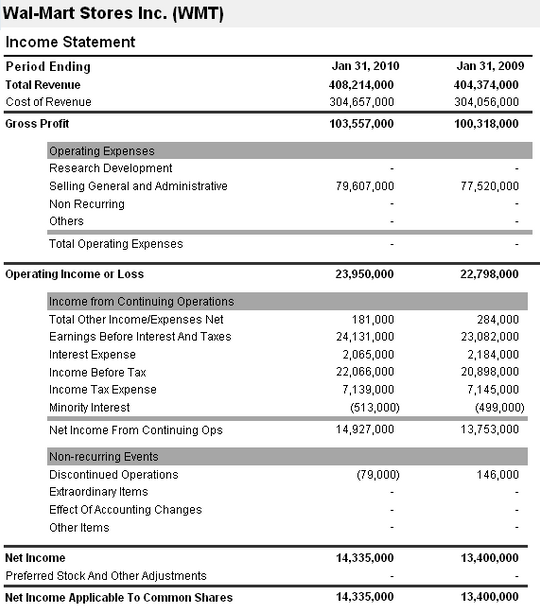

2. The Income Statement:

firm’s financial record over a period of time, it can be a quarter or a whole year. The income statement shows you money coming in (revenues, also known as sales) versus the expenses tied to generating revenues.

3. Cash Flow Statement:

A company’s only reason for existing is to produce cash that can be distributed to shareholders. This dynamic is called a “positive cash flow.”

4. What to look for in a balance sheet?

4.1 Total Revenue Compare a year on year revenue to see whether a company is generating enough cash. This is where you can see the life line of the company, sales.

4.2 Gross Profit

Cost of Production Vs Sales Price, If its a negative it’s usually a bad sign

4.3 Operating Expenses(OE) & Profits (OP)

OE are the company’s spending. Paying its employees, R&D and Insurance, are calculated in OE.

OP are earnings of a company, Operating Revenue – Operating Expenses = Operating Profit

4.4 Net Income

Revenue – Expense = Net Income. It is what is being distributed to the shareholders I hope this covers the basics of what you need to read a company’s financials! Let us know what you would like to know more!