To be successful at portfolio investing, you don’t have to be affluent. However, in order for your investing portfolio to equal or even exceed the larger stock market, you must have a fundamental understanding of how to invest. Let’s go through the fundamentals of how to put together a sound investing portfolio and choose suitable companies for new investors.

Understanding what an investment portfolio is

For some of you, you may not even know what an investment portfolio is. A portfolio investment is one that you make with the hope that the asset will increase in value or create income in the form of interest or dividends. A portfolio investment is different from a direct investment in a firm since your share is passive, which means you don’t make management choices. The following items can be included in your investing portfolio:

- Stocks

- Bonds

- Mutual funds

- Exchange-traded funds (ETFs)

- Real estate investments, like real estate investment trusts (REITs)

- Cash equivalents, such as certificates of deposit (CDs) or savings accounts

Before you Start to build your portfolio, you must ask yourself these questions:

- How much money do you have to invest?

Do not make a long-term commitment to invest more than you can easily afford. Remember that most investments have certain costs; for example, unit trusts include a variety of fees and charges. Think of it this way “If I lose this amount of money, will it interfere with my monthly financial needs”

- How much time do you have to invest?

Staying involved for a longer length of time also gives you more time to ride out market swings which means that you’ll have more time to compound your earnings. If you need to withdraw your investment in short-terms, you should search for low-risk, easy-to-liquidate investments (e.g. Singapore Savings Bonds).

- How much are you willing to risk?

Take into account your family’s short- and long-term demands; if you have more immediate needs, you should make fewer hazardous investments. Will a loss in your investment have an influence on your other obligations, such as loan repayments? If you don’t have the time to recoup from your losses, don’t take the risk. When it comes to investing your retirement funds, be extra cautious.

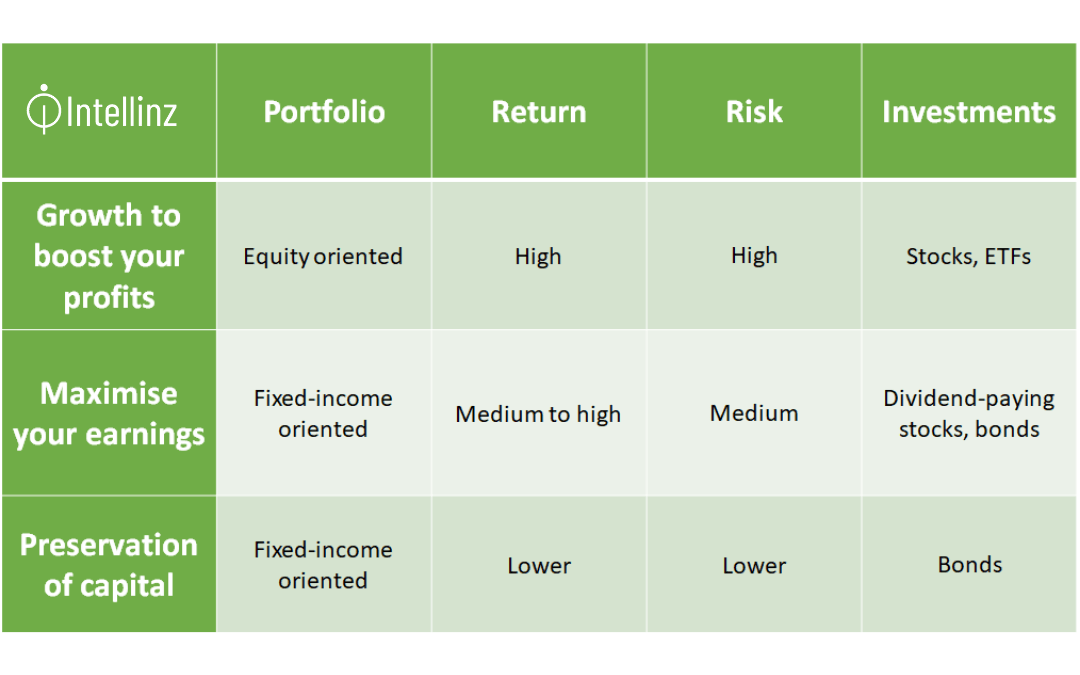

Once, you have figured out the answers to these questions, you will be able to know your investment style, budget and risk tolerance. Once you calculate how much money you’ll require and when you’ll require it for each of your financial objectives. This will assist you in determining the returns required to meet your objectives. You can refer to the table below to figure out which investment portfolio to go for:

- If you’re just starting out, your investment goal should be to increase your capital.

- If you’ve already met your savings goal, your investment goal could be to protect your assets.

- If you’ve retired and need to access your savings, you’ll want to make sure your investments have high liquidity, or the ability to turn them into cash fast. You may also like to earn an income from your savings.

Nowadays, it’s much easier to access investment opportunities and access through buying stocks, bonds, EFTs and equity through online investment brokers apps or websites. However, regardless of how appealing a particular investment may appear, ALWAYS DO YOUR DUE DILIGENCE!

Never invest in anything that you have no idea about, DO YOUR RESEARCH! Or talk to people who are well versed in the world of investing. You should also avoid procrastinating and deferring your investment till a later date.